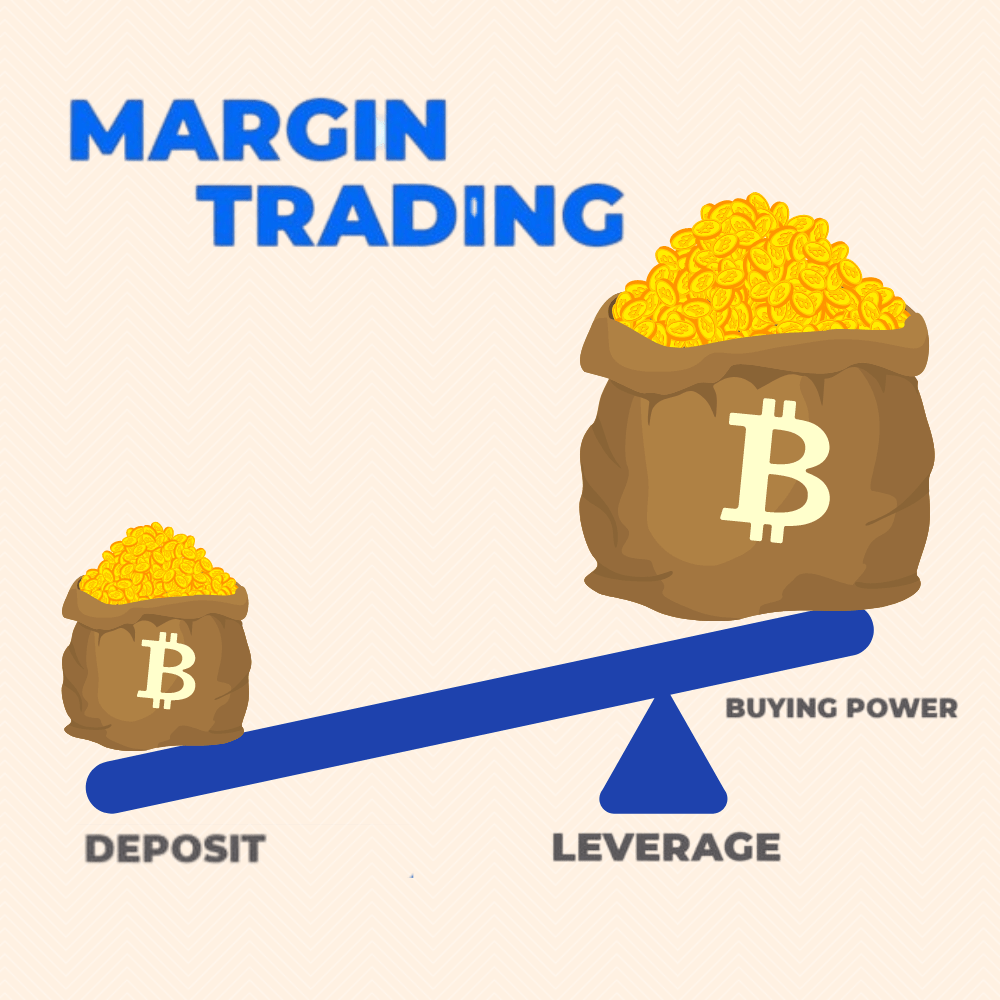

Do you know what margin trading is? Margin trading means that securities companies can conduct securities trading after collecting the margin of both parties.

That is to say, this margin serves as a pledge. Only by pledging cash or relevant securities as collateral can the person conducting the transaction obtain loan funds more smoothly. So how is the interest rate determined? It depends on the length of time. He will charge you interest regularly. Take a specific example: imagine that you want to get 20000 shares, and your broker clearly requires 50% of the margin, so 20000 times 50% is 10000, that is to say, the final loan amount you get is 20000 minus 10000 equals 10000, of which 10000 is paid to the margin.

Note that the implementation process of margin trading uses the corresponding account, that is, you cannot use the cash account to realize this trading activity. Let's explain what a margin account is. If you charge a certain amount of securities to such an account, you can use it as the margin to be delivered to the broker when you deliver the margin, or we call it mortgage here. You know, such accounts are very standard. Because the margin requirement is set by the broker after thinking, they have different corresponding requirements for different trading activities, so as to provide services between you.

Next, we will analyze the advantages and disadvantages of the following margin trading:

Different people hold different views on such a transaction. Those who support margin trading are enthusiastic about such trading activities because they think, first of all, those who intend to carry out such investment and financing activities have more ability and confidence to carry out loan services. With such activities, they have more capital in their accounts and make them more confident. In short, the purchasing power of investors has been greatly improved. After the transaction, they have more autonomy and consumption rights than before.

Second, they have gained more unknown potential benefits and returns.

But those who do not support also have their ideas:

First of all, they believe that since it is borrowing, it is accompanied by unknown risks. They will eventually pay interest even if they buy securities that will depreciate in the future.

Secondly, the setting of margin requirements requires them to consider their next situation carefully.

Also, at first, they must deposit a certain amount of margin into the account, which is set according to the total amount of your transactions. Even if margin trading has been carried out, the price of the securities or stocks you buy in the market is not fixed, but will change with the changes of the market. Worse, if you do not pay all the amount of the margin, you will receive relevant reminders and notices to urge you to deposit the remaining amount of the margin. If you still fail to meet the requirements after a period of time, the securities company where you purchased the securities has the right to close the position.