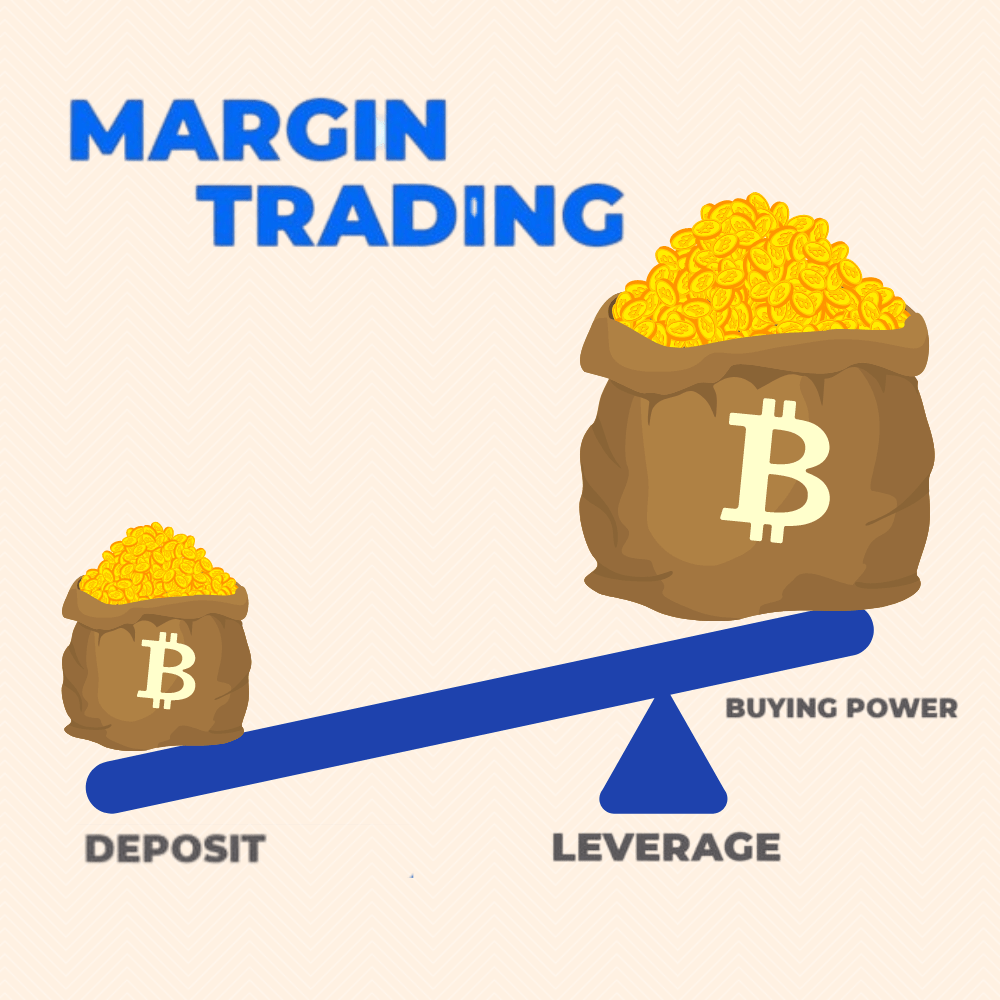

In the process of securities trading, when the parties buy and sell securities, they need to pay a certain amount of margin to the securities company. This is called margin trading. You will get financing or loans from the securities company. Margin is the amount of money you put with a broker as security when you borrow money to buy a security.

You need to know that securities or funds in a brokerage account can be used as collateral for an investor's loan. It is calculated and charged at a fixed rate on a regular basis. For a simple example, if your broker requires a 60% margin at the beginning, and the value of the stock you want to buy is $10,000, you will need to pay a margin of $6,000, and your broker will provide you with the remaining $4,000.

When it comes to trading, your regular cash account won't work. What it does is that the cash or securities in its account can be used as collateral for loans by the householder. Different brokers have different rules and requirements for margin trading and offer different terms of service. The economy can according to their own ideas to regulate investors to pay the margin and interest rate charge requirements. Since margin trading is leveraged, investors' gains and losses can be magnified.

Advantages: First, it will increase people's purchasing power. This is one of the most significant advantages of margin trading, because margin trading can be financed with loans, thus reducing the burden on investors and allowing investors to buy more shares with the money they would normally spend. Second, margin trading offers higher returns. There is a larger potential profit margin.

Disadvantages: First of all, high profits are associated with high risks. Similarly, margin trading also has high risks. Secondly, borrowing money is not given to you for nothing, it has interest. When you invest with a margin, you pay interest on time and regularly based on the amount of money you borrow. So before you take out a loan to invest, consider whether you can afford the cost and regular interest. Finally, there are certain preconditions for margin trading. When an investor wants to make a trade, you must have an initial margin in your margin account, which is set as a percentage of the amount of the trade. Your margin will be deposited into your margin account after you pay it. So what does the initial margin do? The initial margin acts as a safety net, protecting counterparties from losses if the value of the securities they bought falls and the loan cannot be paid.

After margin trading, investors may be required to increase the margin amount if they do not consistently meet the margin requirements set by the exchange. This requires you to put more margin in your margin account, and if you do not deposit the raised margin in time to meet their requirements, the securities firm has the right to force liquidation.