The key for us to invest is to create our own investment system.

System is different from strategy. The strategy is how to invest specifically. For example, "fixed investment on a regular basis" is an investment strategy; "grid" trading is also a strategy.

The strategy aims to solve specific investment problems. Including the buying and selling point, trading time and space of an investment. Strategy is very important. Without strategy, we can only invest by emotion, relying on luck. Without strategy, 99.99% of investors will never succeed.

However, strategy is not the same as system.

There is no perfect strategy in the world. If does, it will be impossible for everyone to use it.

At this time, we need several different strategies to form a "trading system". Like fighting, there are ground forces, air forces and missile forces. We must cooperate with each other to win the war.

In a mature trading system, long-term strategies, short-term strategies and other trading strategies must match each other.

However, trading strategy is not the whole investment system.

In addition to the trading system, the investment system should also include an "observation system". You can understand it as a reconnaissance unit of an army. Including scouts, radars, unmanned aerial vehicles, early warning aircraft, etc.

The function of observation system is to let you know the overall situation of the current battlefield and the situation of the enemy. When it comes to investment, you need to know: the tendency of monetary policy; macroeconomic cycle environment; mass sentiment; market status; valuation status of the transaction target; trend form, etc.

After all the information is collected, you need to make your own judgment like a real commander, and then use different strategies to achieve your investment goals. The experience of investment will continue to evolve. It is not difficult to add new things to our seemingly mature investment system.

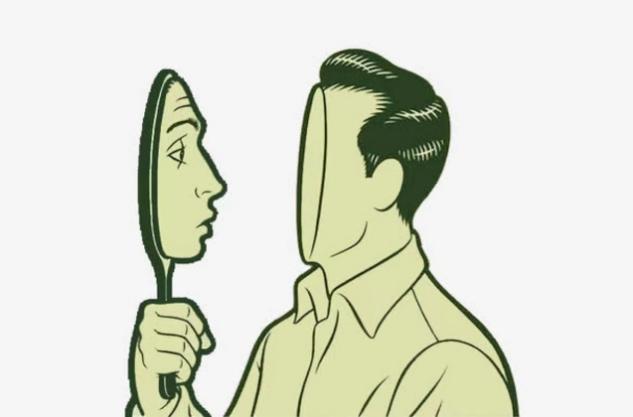

First of all, we need to make sure that there is absolutely no perfect investment system in the world. Both yours and mine must have their inherent defects. It is not difficult to admit this. If you don’t admit it, the result is that your investment income cannot be improved. We admit that we are not perfect in our heart, and everything is easy.

We need self-examination. Regardless of the success or failure of investment in the past stage, we should constantly do self-examination. Think over why we do well or why we don't.

If there is no mistake in the system and strategy, and the result is not satisfactory due to the lack of strict implementation, then warn yourself to improve the execution. If there is a problem with the system and strategy, improve the system and strategy.

All the improvements come from reflecting on the past shortcomings. Try to minimize the deficiencies and carry forward the advantages.

You can see how important time and experience are. Without several rounds of bull bears, no matter how talented traders are, it is impossible to create a complete and suitable investment system. These things cannot be accomplished by reading and learning from the master's strategy and system.

If you found a complete system that suits you, it's very good. But you should polish it to suit you, and then continue to evolve.

For those who have not yet created their own investment system, you must find your own general direction first. Do you like to study stocks, trends, research asset allocation?

The optimal solution is to choose a direction and continue to create the system. Because no matter which direction, it will take a lifetime to achieve it.